February 14, 2024

by twest

1 Comment

February 13, 2024

BANKS GOT BAILED OUT, WE GOT SOLD OUT – AGAIN.

The banks are getting off easy, again. The savings and loan scandal produced more than 1,000 felony convictions; this banking fraud is more than 40 times worse. How can our government let these fat cats get away with it? The 99% is disgusted and finds the foreclosure abuse settlement unacceptable. We demand accountability and justice for the criminals involved, not a robo-settlement.

Unbelievably, despite the banks’ blatant failure to use their 2008 bailout funds the way they were intended, to prevent foreclosures, the government will initially depend in large part on the banks’ own reporting in order to police compliance with this settlement. Worse, now that things are settled, the banks will step up the property seizures. It is estimated there will be 1 million foreclosures in 2012. The modern-day robber barons are at it again.

And what about prosecution of the corporate criminals? There have been very few so far, and this settlement will make it less likely there will be any in the future. By settling, our officials have given up the right to sue mortgage servicers for foreclosure abuses and robo-signing. Without any measure of accountability, these predatory lenders will continue on their path of financial ruin of the American people.

First, banks were bailed out by the federal government with no obligation to help homeowners in danger of foreclosure. Naturally, therefore, they only helped themselves. Now they are getting a light slap on the wrist from 49 state attorneys-general in the settlement orchestrated by the federal government, without any measure of true accountability for their overall actions.

It is widely known how the banks cheated millions of homeowners with predatory lending, and how mortgage-backed securities brought America to the brink of ruin. California’s Central Valley was one of the hardest hit areas. Now, after four years in which our government failed to engage in any meaningful enforcement, the banks are being let off too lightly. In essence, they are getting a second round of bailouts under the guise of “helping” distressed homeowners.

The five large banks — Bank of America, Citigroup, Wells Fargo, JP Morgan Chase and Ally Financial — will pay $25 billion in compensation. But only $5 billion will actually come from the banks’ pockets. The remaining $20 billion will come from the mortgage-backed securities investors, such as pension funds, 401(k) plans and insurance companies, themselves victims of the banks.

Moreover, only a mere pittance of homeowners will gain relief from this “bailout.” The actual assistance the homeowners will get is as follows:

- $17 billion in debt forgiveness, forbearance and loan modifications: Of 11 million homeowners who owe more than their houses’ market value, 92 percent, including all whose loans are owned by Freddie Mac or Fannie Mae and or whose loan isn’t held by one of the “big five” banks, will be excluded. They are flat out of luck. For the rest, the amount allocated averages around $20,000 each, less than a third of the average amount these borrowers are underwater.

- $1.5 billion in compensation for those who have already lost their homes: More than 4 million homeowners were foreclosed on in the last four years. Only 750,000 of these homeowners will receive this new compensation, and the amount will only be $2,000 per house. That barely covers the cost of moving, let alone reimbursement for the lost home. How is that a fair settlement for someone who lost their home because of deceptive loan practices, bank negligence, or outright fraud?

Occupy Sacramento believes that this settlement will provide very little relief for the millions of homeowners who have suffered, and continue to suffer, from the foreclosure crisis. A paltry $2,000 does not begin to rebuild the shattered lives of those who have been evicted from their homes. Homeowners who were victims of mortgage fraud before 2008 will receive nothing from this settlement. Homeowners whose loans are held by Fannie Mae or Freddie Mac-over half of all homeowners-are not only excluded from this agreement, they continue to be denied any chance at principal reduction. And even most eligible homeowners who are underwater will find that the principal reduction they receive is not enough to keep them from sliding into foreclosure.

We need an agreement that provides real relief for homeowners. Reduce every house’s principal to current market value. Give evicted homeowners enough compensation to afford a decent, safe place to live. Make the banks pay a larger share of settlement costs. Negotiate affordable monthly payments. Give government the resources and power to force banks to negotiate in good faith.

And we need a foreclosure moratorium, so that no more homeowners are wrongfully turned out of their home because of a banking system that is still a long, long way from being fixed.

Tweet

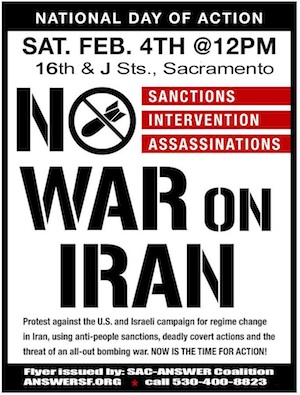

Saturday, February 4th

Saturday, February 4th